You’ve Been Referred for an Exclusive Deal

Someone you know thinks FreshBooks could help make your life easier. We agree, and we want to start by giving you 90% off for your first 3 months. We don’t give these deals to just anyone, but we’re big fans of helping our new friends save money.

Offer terms:

Montly Plans

Get 90% off a Lite, Plus, or a Permium Plan for 3 months. After the 3-month promotional period, you will be billed at full price for the plan you have selected.

Yearly Plans

Total yearly price is billed at time of purchase. Get the 90% promotional discout + 10% yearly discount on a Lite, Plus, or a Premium plan for 3 months. After the 3-month promotional period, the 10% early discount will continue for the remaining period of your yearly plan.

Promotional offers for both monthly and yearly plans are for a limited period. New customers only. Cannot be combined with other offers. No free trial period is included when availing of this promotional discout. FreshBooks reserves the right to change this offer at any time.

The Tools You Need to Succeed

Just like you, we come highly referred. Here’s what our friends have to say about us.

(Not pictured: The other 30-million FreshBooks users.)

“We had a record year this past year. Could we have done it without FreshBooks? I don’t know how we would have.”

“I found FreshBooks to be so intuitive. I was easily able to do time tracking, expense tracking, and invoice customers.”

“The competitve pricing of FreshBooks and the user interface, it’s just very user-friendly. For someone in branding and marketing PR, that’s important.”

4.5 Excellent

“FreshBooks offers a well-rounded, intuitive, and attractive double-entry accounting experience that supports invoices and estimates; expenses; time tracking; and projects.”

4.4 Excellent

“FreshBooks automates daily accounting activities namely invoice creation, payment acceptance, expenses tracking, billable time tracking, and financial reporting.”

4.5 Excellent

“FreshBooks is an online accounting and invoicing service that saves you time and makes you look professional – Fortune 500 professional.”

4.47 Excellent

(Read more from Software Advice)

“FreshBooks takes billing out of your hands and puts it on autopilot. Set up automated invoicing, online payment options, and late payment reminders to get paid 2x faster.”

Find Even More Efficiencies in Our Massive Network of Intergrations

FreshBooks integrates with over 100 great apps to streamline work for business owners, keep teams and clients connected, and better understand your business.

Frequently Asked Questions

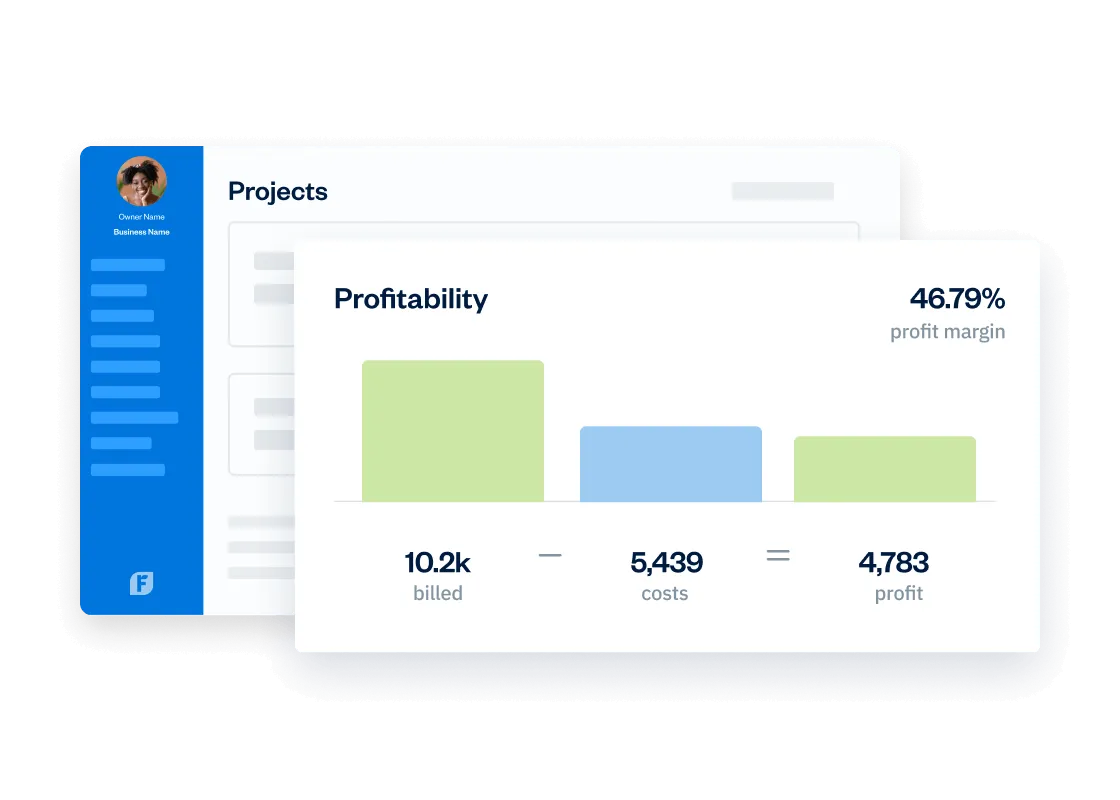

FreshBooks accounting software gives you instant access to the tools you need to manage your finances. It’s the perfect accounting solution for everyone from self-employed professionals to growing business owners.

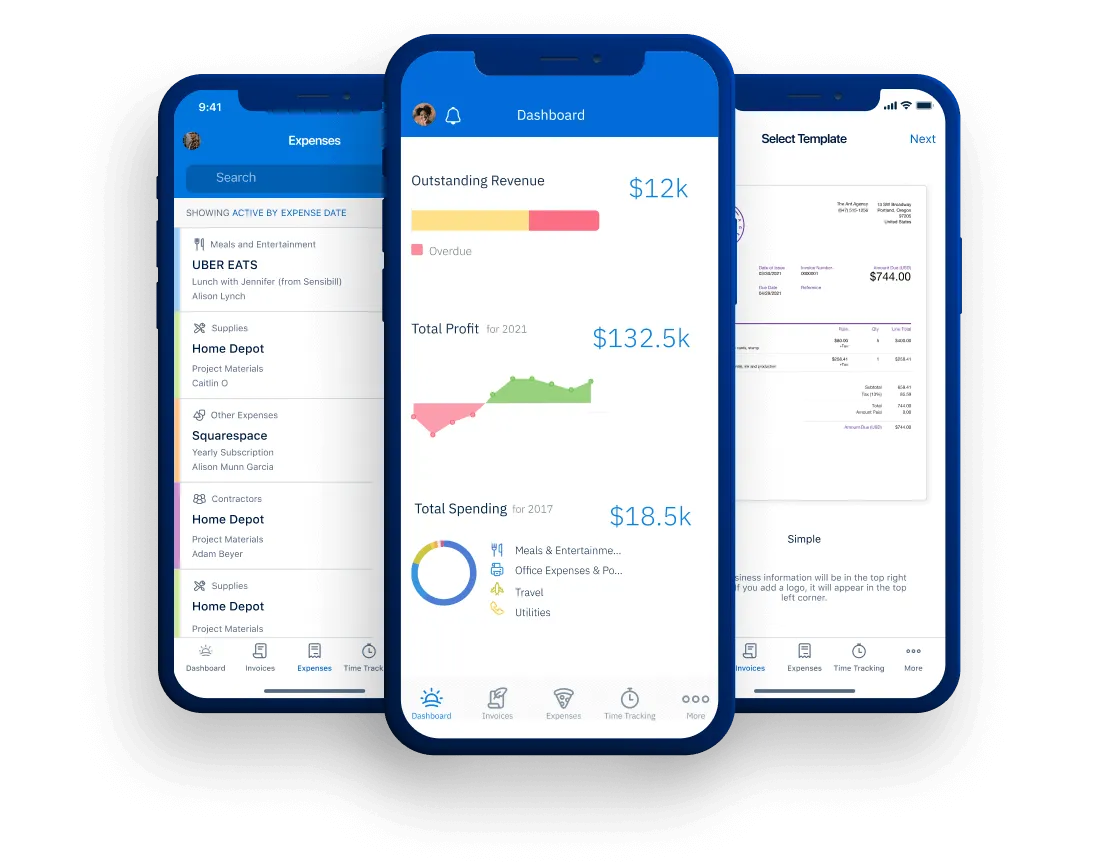

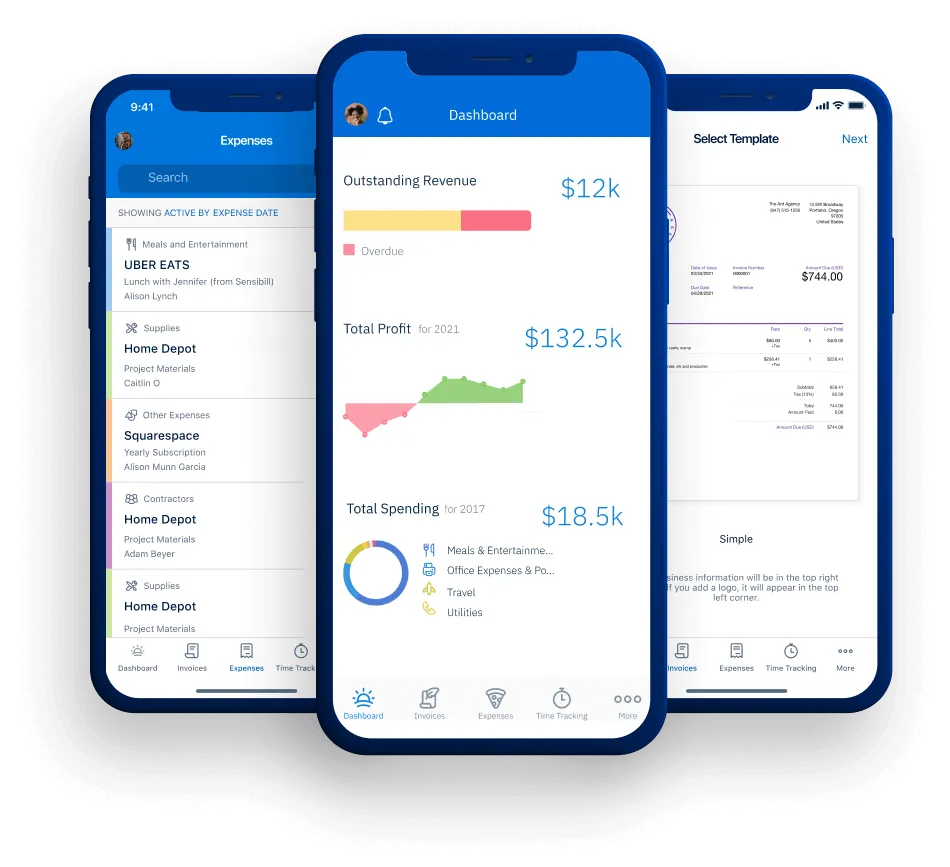

All you have to do is sign up for a FreshBooks account, add your business details, and you’re ready to go. From the FreshBooks dashboard, you can explore the invoicing features, add billable clients, choose to accept credit card payments with FreshBooks payments, run accounting reports, discover the project management tools, and a whole lot more.

Plus, if you prefer to manage your business on the go with a mobile device, you can download the FreshBooks mobile app—and handle your accounting from anywhere.

FreshBooks offers a selection of plans specifically built for small business owners. But which one is right for you? How do you know which accounting software features are right for your small business, to save you time and get you paid faster? FreshBooks plans are as follows:

- Lite Plan (add up to five clients)

- Plus Plan (our most popular plan)

- Premium Plan (lots of advanced features)

- Select Plan (a customizable plan for growing businesses)

All of your information stays in your account.

Want to know how much FreshBooks costs? We know every small business is different, which is why there are different plans to choose from. You can review them here. Our advice? Take a moment and take stock of:

- Where your small business is today

- Where you hope to grow your business in the next 6 months

- Your overall income and expenses

- The features you need to help your business accomplish all its goals

- Do you need business health reports?

- Do you need mobile mileage tracking?

Read this article for even more information to help you choose the right FreshBooks plan for your business: Wondering Which FreshBooks Plan Is Right For You?

FreshBooks is a super-easy-to-use accounting software built specifically for small business owners, letting you easily do everything yourself. However, when it comes to using all the tools available to you as a small business owner, your accountant should definitely be part of your toolbox.

Sending customizable invoices and managing billing and invoicing for several businesses in FreshBooks might be right up your alley, but leveraging insights from accounting reports and accounting features might be something you want a second set of eyes on.

Not only does FreshBooks allow small businesses to add their accountant to their account, but FreshBooks also has an Accounting Partner Program that pairs small business owners with accountants. This ensures that businesses are matched with accountants that suit their specific needs, and gives them access to the financial and accounting reports they need.

Talk to your accountant and see how easy it is to work together. And if you need a hand our phone support with a live rep extends to both you and your accountant with no additional fees.

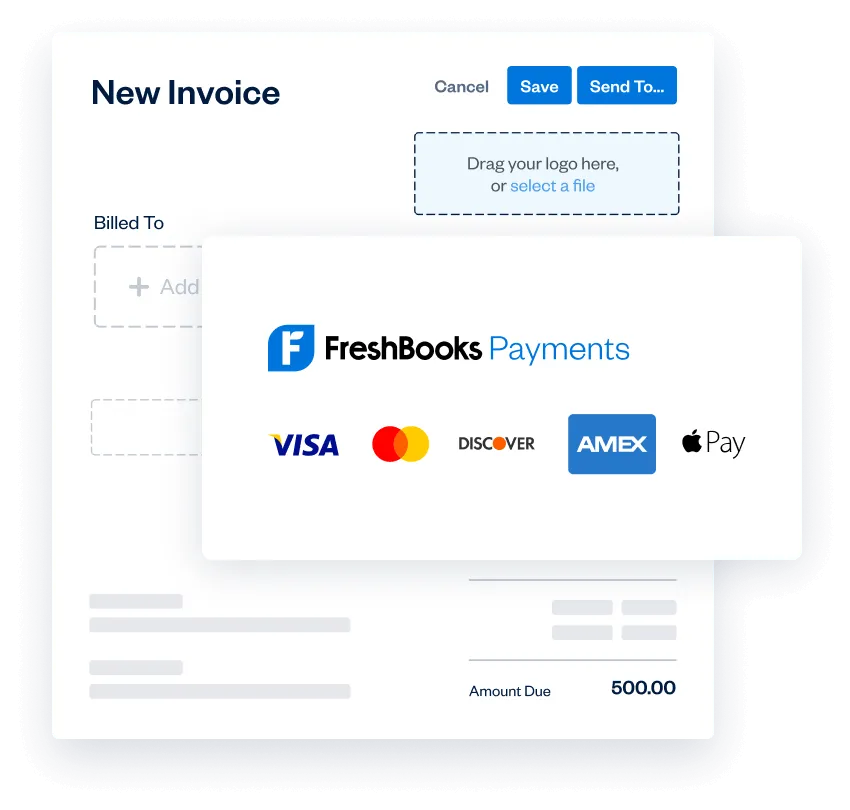

There are a number of payment processors and payment options you can choose through FreshBooks.

FreshBooks integrates with a number of payment processors so that you can choose the payment method that works best for you and your business. Whether you want to accept credit card payments, set up bank transfers, or get paid through FreshBooks Payments, you can easily set up the method you prefer. You can also set up different payment methods for different clients, depending on what suits them best.

The payment providers we utilize are WePay, Stripe, and PayPal in order to provide the following payment methods:

- Major credit cards

- Apple Pay

- Google Pay

- PayPal

- FreshBooks Payments

- Stripe

- Bank Transfers